会计人常说的“四大”指的是什么?有ACCA就能进吗?

发布时间:2020-02-05

在一些会计人的心中,四大绝对是很多人的理想中的工作场所。很多人,尤其是年轻的大学生们的梦想就是进入四大工作。但是真正的四大你了解吗?一起来看看吧!

四大会计师事务所指世界上著名的四个会计师事务所:普华永道、德勤、毕马威、安永。

1、普华永道总部位于英国伦敦。中国大陆,香港地区和新加坡总共有460多名合伙人和12000多名员工。

2、德勤全球2010年的收入为266亿美元,超越普华永道成为全球最大会计师行,在中国拥有员工8000多人。德勤总部位于美国纽约。

3、毕马威成立于1897年,总部位于荷兰阿姆斯特丹,是一家网络遍布全球的专业服务机构,专门提供审计、税务和咨询等服务。

4、安永早于1973年在香港设立办事处,1981年成为最早获中国政府批准在北京设立办事处的国际专业服务公司。1992年,安永在北京成立安永华明会计师事务所。目前,安永在中国拥有超过6500名专业人员,北京、香港、上海、广州、深圳、大连、武汉、成都、苏州、沈阳及澳门均设有分所。

那么,进四大有哪些要求呢?想要通过四大的面试,我们需要注意:

1. 英语。当你的简历上出现通过的ACCA考试科目时,说明你已经具备一定的英语能力了。而且四大是非常喜欢有国外留学背景的,几乎在这里的大多数都有国外经历,因为经常处理的财报就有英文版很多材料也是考出来ACCA其他不说硬性要求的英语标准你就已经基本过关了。

2. 专业。四大从来没有硬性要求应聘者是财会专业的,因为四大希望不同专业的人才可以进入四大工作。你可以不是财会专业,但并不代表你可以对财会一窍不通。ACCA作为一个国际注册会计师这样一个权威的证书,很大程度上可以弥补你专业知识的缺憾。

3.学历。如果你不是985院校毕业,只是一个“双非”或者“二本”,也没有那么没有什么精通的技能或者证书,如果不在别的方面占点优势,如何与他们竞争呢?ACCA可以成为你投简历的敲门砖,它将成为你能力的一个体现。许多四大PAR面的面试官本身就是ACCA会员,对持有ACCA证书的面试者,从个人能力及知识技能上是默认的肯定。

看了上面的内容,相信你对四大以及四大的招聘要求有了一定的了解。如果还想了解更多信息,欢迎来51题库考试学习网留言。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(d) Wader has decided to close one of its overseas branches. A board meeting was held on 30 April 2007 when a

detailed formal plan was presented to the board. The plan was formalised and accepted at that meeting. Letters

were sent out to customers, suppliers and workers on 15 May 2007 and meetings were held prior to the year

end to determine the issues involved in the closure. The plan is to be implemented in June 2007. The company

wish to provide $8 million for the restructuring but are unsure as to whether this is permissible. Additionally there

was an issue raised at one of the meetings. The operations of the branch are to be moved to another country

from June 2007 but the operating lease on the present buildings of the branch is non-cancellable and runs for

another two years, until 31 May 2009. The annual rent of the buildings is $150,000 payable in arrears on

31 May and the lessor has offered to take a single payment of $270,000 on 31 May 2008 to settle the

outstanding amount owing and terminate the lease on that date. Wader has additionally obtained permission to

sublet the building at a rental of $100,000 per year, payable in advance on 1 June. The company needs advice

on how to treat the above under IAS37 ‘Provisions, Contingent Liabilities and Contingent Assets’. (7 marks)

Required:

Discuss the accounting treatments of the above items in the financial statements for the year ended 31 May

2007.

Note: a discount rate of 5% should be used where necessary. Candidates should show suitable calculations where

necessary.

(d) A provision under IAS37 ‘Provisions, Contingent Liabilities and Contingent assets’ can only be made in relation to the entity’s

restructuring plans where there is both a detailed formal plan in place and the plans have been announced to those affected.

The plan should identify areas of the business affected, the impact on employees and the likely cost of the restructuring and

the timescale for implementation. There should be a short timescale between communicating the plan and starting to

implement it. A provision should not be recognised until a plan is formalised.

A decision to restructure before the balance sheet date is not sufficient in itself for a provision to be recognised. A formal plan

should be announced prior to the balance sheet date. A constructive obligation should have arisen. It arises where there has

been a detailed formal plan and this has raised a valid expectation in the minds of those affected. The provision should only

include direct expenditure arising from the restructuring. Such amounts do not include costs associated with ongoing business

operations. Costs of retraining staff or relocating continuing staff or marketing or investment in new systems and distribution

networks, are excluded. It seems as though in this case a constructive obligation has arisen as there have been detailed formal

plans approved and communicated thus raising valid expectations. The provision can be allowed subject to the exclusion of

the costs outlined above.

Although executory contracts are outside IAS37, it is permissible to recognise a provision that is onerous. Onerous contracts

can result from restructuring plans or on a stand alone basis. A provision should be made for the best estimate of the excess

unavoidable costs under the onerous contract. This estimate should assess any likely level of future income from new sources.

Thus in this case, the rental income from sub-letting the building should be taken into account. The provision should be

(b) You are an audit manager in a firm of Chartered Certified Accountants currently assigned to the audit of Cleeves

Co for the year ended 30 September 2006. During the year Cleeves acquired a 100% interest in Howard Co.

Howard is material to Cleeves and audited by another firm, Parr & Co. You have just received Parr’s draft

auditor’s report for the year ended 30 September 2006. The wording is that of an unmodified report except for

the opinion paragraph which is as follows:

Audit opinion

As more fully explained in notes 11 and 15 impairment losses on non-current assets have not been

recognised in profit or loss as the directors are unable to quantify the amounts.

In our opinion, provision should be made for these as required by International Accounting Standard 36

(Impairment). If the provision had been so recognised the effect would have been to increase the loss before

and after tax for the year and to reduce the value of tangible and intangible non-current assets. However,

as the directors are unable to quantify the amounts we are unable to indicate the financial effect of such

omissions.

In view of the failure to provide for the impairments referred to above, in our opinion the financial statements

do not present fairly in all material respects the financial position of Howard Co as of 30 September 2006

and of its loss and its cash flows for the year then ended in accordance with International Financial Reporting

Standards.

Your review of the prior year auditor’s report shows that the 2005 audit opinion was worded identically.

Required:

(i) Critically appraise the appropriateness of the audit opinion given by Parr & Co on the financial

statements of Howard Co, for the years ended 30 September 2006 and 2005. (7 marks)

(b) (i) Appropriateness of audit opinion given

Tutorial note: The answer points suggested by the marking scheme are listed in roughly the order in which they might

be extracted from the information presented in the question. The suggested answer groups together some of these

points under headings to give the analysis of the situation a possible structure.

Heading

■ The opinion paragraph is not properly headed. It does not state the form. of the opinion that has been given nor

the grounds for qualification.

■ The opinion ‘the financial statements do not give a true and fair view’ is an ‘adverse’ opinion.

■ That ‘provision should be made’, but has not, is a matter of disagreement that should be clearly stated as noncompliance

with IAS 36. The title of IAS 36 Impairment of Assets should be given in full.

■ The opinion should be headed ‘Disagreement on Accounting Policies – Inappropriate Accounting Method – Adverse

Opinion’.

1 ISA 250 does not specify with whom agreement should be reached but presumably with those charged with corporate governance (e.g audit committee or

2 other supervisory board).

20

6D–INTBA

Paper 3.1INT

Content

■ It is appropriate that the opinion paragraph should refer to the note(s) in the financial statements where the matter

giving rise to the modification is more fully explained. However, this is not an excuse for the audit opinion being

‘light’ on detail. For example, the reason for impairment could be summarised in the auditor’s report.

■ The effects have not been quantified, but they should be quantifiable. The maximum possible loss would be the

carrying amount of the non-current assets identified as impaired.

■ It is not clear why the directors have been ‘unable to quantify the amounts’. Since impairments should be

quantifiable any ‘inability’ suggest a limitation in scope of the audit, in which case the opinion should be disclaimed

(or ‘except for’) on grounds of lack of evidence rather than disagreement.

■ The wording is confusing. ‘Failure to provide’ suggests disagreement. However, there must be sufficient evidence

to support any disagreement. Although the directors cannot quantify the amounts it seems the auditors must have

been able to (estimate at least) in order to form. an opinion that the amounts involved are sufficiently material to

warrant a qualification.

■ The first paragraph refers to ‘non-current assets’. The second paragraph specifies ‘tangible and intangible assets’.

There is no explanation why or how both tangible and intangible assets are impaired.

■ The first paragraph refers to ‘profit or loss’ and the second and third paragraphs to ‘loss’. It may be clearer if the

first paragraph were to refer to recognition in the income statement.

■ It is not clear why the failure to recognise impairment warrants an adverse opinion rather than ‘except for’. The

effects of non-compliance with IAS 36 are to overstate the carrying amount(s) of non-current assets (that can be

specified) and to understate the loss. The matter does not appear to be pervasive and so an adverse opinion looks

unsuitable as the financial statements as a whole are not incomplete or misleading. A loss is already being reported

so it is not that a reported profit would be turned into a loss (which is sometimes judged to be ‘pervasive’).

Prior year

■ As the 2005 auditor’s report, as previously issued, included an adverse opinion and the matter that gave rise to

the modification:

– is unresolved; and

– results in a modification of the 2006 auditor’s report,

the 2006 auditor’s report should also be modified regarding the corresponding figures (ISA 710 Comparatives).

■ The 2006 auditor’s report does not refer to the prior period modification nor highlight that the matter resulting in

the current period modification is not new. For example, the report could say ‘As previously reported and as more

fully explained in notes ….’ and state ‘increase the loss by $x (2005 – $y)’.

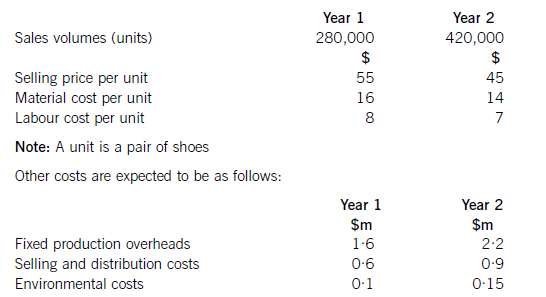

Shoe Co, a shoe manufacturer, has developed a new product called the ‘Smart Shoe’ for children, which has a built-in tracking device. The shoes are expected to have a life cycle of two years, at which point Shoe Co hopes to introduce a new type of Smart Shoe with even more advanced technology. Shoe Co plans to use life cycle costing to work out the total production cost of the Smart Shoe and the total estimated profit for the two-year period.

Shoe Co has spent $5·6m developing the Smart Shoe. The time spent on this development meant that the company missed out on the opportunity of earning an estimated $800,000 contribution from the sale of another product.

The company has applied for and been granted a ten-year patent for the technology, although it must be renewed each year at a cost of $200,000. The costs of the patent application were $500,000, which included $20,000 for the salary costs of Shoe Co’s lawyer, who is a permanent employee of the company and was responsible for preparing the application.

The following information is also available for the next two years:

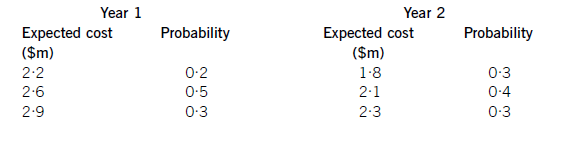

Shoe Co is still negotiating with marketing companies with regard to its advertising campaign, so is uncertain as to what the total marketing costs will be each year. However, the following information is available as regards the probabilities of the range of costs which are likely to be incurred:

Required:

Applying the principles of life cycle costing, calculate the total expected profit for Shoe Co for the two-year period.

(10 marks)

Totalsalesrevenue=(280,000x$55)+(420,000x$45)=$15·4m+18·9m=$34·3m.NoteTheexpectedprofithasbeencalculatedusinglifecyclecostingnotrelevantcosting.Hence,the$20,000salarycostincludedinpatentcostsshouldbeincludedinthelifecyclecost.Similarly,theopportunitycostof$800,000isnotincludedusinglifecyclecostingwhereasifrelevantcostingwasbeingusedtodecideonaparticularcourseofaction,theopportunitycostwouldbeincluded.Working1Expectedmarketingcostinyear1:(0·2x$2·2m)+(0·5x$2·6m)+(0·3x$2·9m)=$2·61mExpectedmarketingcostyear2:(0·3x$1·8m)+(0·4x$2·1m)+(0·3x$2·3m)=$2·07mTotalexpectedmarketingcost=$4·68m

(iii) State the value added tax (VAT) and stamp duty (SD) issues arising as a result of inserting Bold plc as

a holding company and identify any planning actions that can be taken to defer or minimise these tax

costs. (4 marks)

You should assume that the corporation tax rates for the financial year 2005 and the income tax rates

and allowances for the tax year 2005/06 apply throughout this question.

(iii) Bold plc will be making a taxable supply of services, likely to exceed the VAT threshold. It should therefore consider

registering for VAT – either immediately on a voluntary basis, or when its cumulative taxable supplies in the previous

twelve months exceed £60,000.

As an alternative, the new group can apply for a group VAT registration. This will simplify its VAT administration as intragroup

transactions are broadly disregarded for VAT purposes, and only one VAT return is required for the group as a

whole.

Stamp duty normally applies at 0·5% on the consideration payable in respect of transactions in shares. However, an

exemption is available in the case of a takeover, reconstruction or amalgamation where there is no real change in

ownership, i.e. the new shareholdings mirror the old shareholdings, and the transaction is for commercial purposes. The

insertion of a new holding company over an existing company, as proposed here, would qualify for this exemption.

There is no VAT on transactions in shares.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-21

- 2020-04-18

- 2020-05-16

- 2020-01-30

- 2020-01-09

- 2020-01-10

- 2020-03-08

- 2020-03-08

- 2020-01-10

- 2020-05-03

- 2020-01-09

- 2020-09-03

- 2020-05-09

- 2020-01-10

- 2020-04-10

- 2021-04-24

- 2020-04-29

- 2020-02-20

- 2020-04-16

- 2019-07-20

- 2020-02-19

- 2020-05-08

- 2020-04-18

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-02-04

- 2020-01-10

- 2020-01-10